Banks, what banks?

We woke up on the 27th with unusual news: Google's request for a license as a banking entity in Europe, particularly in Lithuania. Let's be honest, if you are under 40 years old, you are surely allergic to going to your “old bank.” Of course there will be these types of entities in the future, but they may be your trusted search engine, your electricity company or any other established brand with a large user or credit card base.

The way we understand money is changing, without a doubt, and these modifications increasingly affect more demographic profiles of the population and are filtering into our daily lives.

We don't have to be very visionary to know that this change is coming in macroeconomics, but what about microeconomics? It is clear that medium and small companies have been very slow in everything related to online sales and payments. Proof of this is the damage that giants like Amazon have done to the sector. It's time to be faster and acquire this know-how more quickly:

“The most obvious solution is to train your staff or incorporate new blood that knows and understands this fully digital economy”

The sole proprietorship is also in full bloom with cashless payments, such as those proposed by Apple Pay, Samsung or Google itself. Even the obsolete Spanish banking sector has gotten its act together with excellent solutions such as Bizum. This means that the immense network of SMEs, self-employed workers and companies are beginning to have payments and possible income everywhere in systems other than the classic one.

I want you to be empathetic with those administrative or accountants, that golden sixth player that every small and large company has and, in their tired gaze (it doesn't matter if they are an intern who smells like a baby bottle) when they have to liquidate the quarterly VAT and see a payment with Samsung Pay or a transfer through Bizum. And not to mention the use that many professionals are making of fintech platforms such as Fintonic, which becomes your “semi-intelligent” accounting manager.

2019 will undoubtedly be the turning point for intelligent economic managers and financial directors who provide their companies with this new economic, social and consumer paradigm.

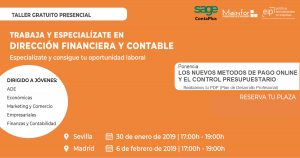

For now, in your case I would reserve a place in the face-to-face workshops/workshops that we are doing in different cities so that you can really get to know a current postgraduate program with the added value to improve your resume or open the door to your first job in the sector.

By the way, the melon of bitcoins and fintech will be opened another day by the director of the financial area of EIP, Raul Ruiz.

RESERVE A PLACE IN THIS LINK.